In the Great Energy Race, Coal Takes Another Hit

Source: U.S. Energy Information Administration, Form EIA-860, “Annual Electric Generator Report.” Note: Capacity values represent net summer capacity.

Earlier this month, the U.S. Energy Information Administration (EIA) announced that natural gas energy production finally tied with energy generated from coal in April. Now, that group is projecting that energy from coal-fired plants will likely contract in the next five years.

Between 2012 and 2016, almost 27 gigawatts of energy production from 175 coal-fired generators are expected to be lost – an amount that accounts for 8.5% of total coal-fired energy generation in 2011.

These losses are more than four times greater than the losses experienced during the last five-year period. And 2012, by all accounts, should be the largest one-year decline in coal power generation thus far with a total loss of 9 gigawatts.

According to the report by the U.S. Energy Information Administration, several factors have contributed to coal’s decline:

- Modest demand growth. Slowing electricity demand growth has led to declining use of some of the smaller, older, less efficient coal plants.

- Relative fuel prices. Relative prices of natural gas and coal as sources of energy, which have moved in favor of natural gas with the boom in shale gas production. The variable costs of operating natural gas-fired capacity have fallen relative to those of coal-fired plants.

- Availability of the combined-cycle plant fleet. The availability of highly efficient natural gas combined-cycle power plants that are currently not fully utilized.

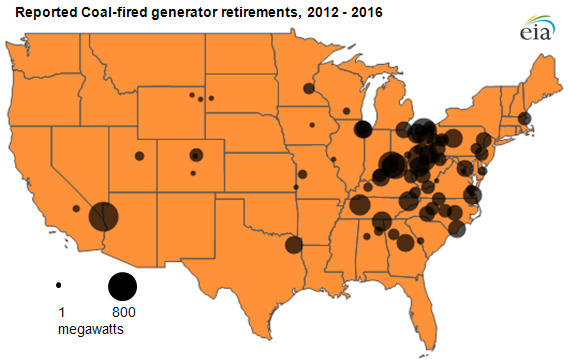

- Aging coal-fired generators. Most of the country’s older coal capacity is concentrated in the Mid-Atlantic, Ohio River Valley, and Southeastern U.S (see map above) due to proximity to the primary U.S. coal supply regions at the time of their construction.

- Environmental compliance costs. The cost of compliance with anticipated and existing federal environmental regulations such as the Mercury and Air Toxics Standards (MATS) is a factor. Particularly in the case of older, smaller units that are not used heavily, owners may conclude it is more cost efficient to retire plants rather than make additional investments.

- Other compliance costs. The cost of compliance with anticipated and existing state laws and regulations including renewable portfolio standards.

Source: U.S. Energy Information Administration, Form EIA-860, “Annual Electric Generator Report.” Note: Data for 2005 through 2011 represent actual retirements. Data for 2012 through 2016 represent planned retirements, as reported to EIA. Data for 2011 through 2016 are early-release data and not fully vetted. Capacity values represent net summer capacity.

This trend seems to align with the fate of several proposed coal plants In Texas.

Last week, the proposed Las Brisas Coal Plant of Corpus Christi lost its air permit. And the proposed White Stallion power plant of Matagorda County still hasn’t been able to secure a water permit from the Lower Colorado River Authority (LCRA), though it has indicated it may be able to use air cooling and groundwater from private landowners to supply the plant.

The U.S. Energy Information Administration predicts that a total of 10 gigawatts from coal-fired plants will be lost in 2015 alone.

Sheyda Aboii is an intern with StateImpact Texas.