Natural Gas Exports to Mexico Skyrocket

Photo by Mose Buchele for StateImpact Texas

The Mexican border. More and more pipelines are being built to bring natural gas from Texas into Mexico.

When the U.S. Department of Energy (DOE) announced that it would issue a permit to export liquified natural gas to new markets from a facility in Texas recently, the news was greeted as a game changer. Opening international markets could drive the price of natural gas up domestically, spur a new rush to drill for gas, and stimulate some parts of the economy while disrupting others.

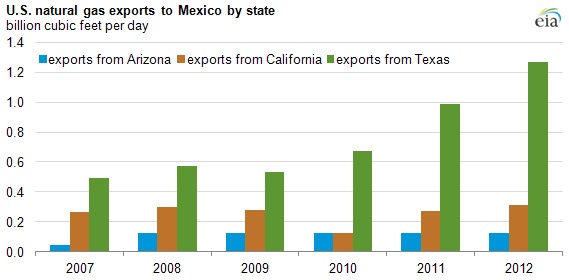

Despite all that excitement, a second, quieter, natural gas export boom is already taking place right under our noses. Mexico is importing a record amount of natural gas to create electricity and feed its growing industrial base. Eighty percent of all the gas Mexico imports comes from the United States, and 60 percent comes directly from pipelines in Texas.

“That’s something that most people probably haven’t been aware of,” David Blackmon, an industry consultant and natural gas advocate told StateImpact Texas. “We’ve always exported natural gas into Mexico, so this whole debate over whether we can export it in liquid form rather than pipelines has always kind of befuddled me.”

The reason the U.S. can export via pipeline to Mexico without much fanfare has to do with federal regulations. Those require a special permit from the DOE to export liquified natural gas to non-free trade partners. Exporting liquified gas opens up overseas markets, something that would have a more profound impact on prices at home, so the DOE has issued only two such permits to date.

Map courtesy of the EIA

A map showing major pipeline projects in the works between Mexico and the US.

Along the Mexican and Canadian borders, however, pipelines are built under a different regulatory process. And in South Texas, they can’t seem to build them fast enough.

A recent report from the U.S. Energy Information Administration outlined several new pipeline projects, many from Texas, that are scheduled to be built by the end of 2014. If those projects are completed they could double the amount of natural gas the U.S. has the capacity to export to Mexico to about 7 billion cubic feet per day. That’s five times the maximum amount of natural gas that Freeport LNG will be allowed to export under the Department of Energy permit that caused such a stir last week.

While pipeline builders work to increase capacity, the U.S. currently exports about 1.7 billion cubic feet per day. Almost all of that not only comes from Texas, but from one specific part of the state: the EIA notes that “most of the U.S. exports to Mexico departed the country from Hidalgo County in southwest Texas, where the supplies were likely coming from the Eagle Ford play.”

How you take that news will depend on what you think of fossil fuels and hydraulic fracturing or “fracking,” the drilling technique that has unlocked vast reserves of natural gas across the U.S.

Whether the growth in exports to Mexico continues depends on other things.

One of the reasons for the export boom has been the relatively low price of natural gas in the United States. If that price rises, as it may if the U.S. starts exporting more gas overseas or finds more uses for natural gas domestically, Mexico could begin buying less.

Another factor will depend on Mexican energy policy. Right now, Mexico does not possess the technology and resources to unleash its own reserves of shale gas through fracking. But the country could invest more in domestic natural gas drilling in the future.

Mexico’s new president is also expected to propose changing the country’s laws to allow its state-owned oil and gas monopoly to partner with foreign companies. That may boost Mexico’s production enough within its own borders to cut down on imports.

But for now — as all the pipeline building attests — U.S. companies seem confident that Mexico will need American gas for the foreseeable future. Mexico is forecast to add 28 gigawatts of new electric capacity by 2027. That could raise the gas needs for power generation by over 5 billion cubic feet a day.

“This level of growth would likely require increased natural gas imports from the United States,” reports the IEA.