Electric Deregulation Turns Ten in Texas

Photo by Flickr user Sharon Drummond/Creative Commons

Deregulation turns ten years old in Texas this year.

Anniversaries are horrible things to forget, so here’s one that you might have let slip by. This month marks ten years of de-regulation in the Texas electricity market.

But it hasn’t all been smooth sailing for rate payers since then, according to one new study.

A typical electric customer paid $3,000 in added costs over the last ten years because of deregulation, according to a history commissioned by the Texas Coalition for Affordable Power. The report estimates that Texans spent $11 billion cumulatively because of higher rates.

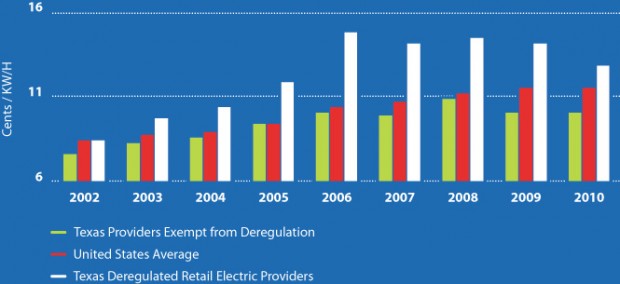

Here’s a table from the report that shows exactly that:

Graphic Couresy of the Texas Coalition for Affordable Power

A graph from the TCAP report showing average residential electricity prices inside and outside deregulated areas of Texas.

Geoffrey Gay, lead counsel to the Coalition, says one of the reasons is the way retail electric providers operate in Texas.

“We have a system where we have numerous, hundreds maybe, of retail electrical providers who really add no value to this system. By law they can’t own wires. They don’t own the distribution system, they don’t own the meter. By law they can’t own any distribution sources. So they are truly an unnecessary intermediary,” said Gay.

Defenders of deregulation argue that Texas has seen unprecedented growth in the past ten years. Mark Bruce, with the consulting firm Stratus Energy Group, says that makes it difficult to compare rates in Texas with other states.

“To give you an example, for like four years in a row leading up to the ’08 recession, the Dallas Fort-Worth area added the electrical equivalent of Little Rock, Arkansas every single year,” Bruce told StateImpact Texas.

The Texas grid will face challenges in the coming year. According to the report, Texas has one of the lowest electric reserve margins in the country. That means we are at a greater risk of rolling blackouts during times of high energy use.

Texas lost a large amount of anticipated new electricity production when the Sandy Creek Energy Station outside of Waco announced that an accident will keep it from coming online this year. That illustrates just how dependent the state is on private investment in a deregulated market, argues Gay.

Graphic Couresy of the Texas Coalition for Affordable Power

A graph from the TCAP report shows how rates have changed in Texas after deregulation.

“Regulators including the Public Utility Commission and the Electric Reliability Council of Texas (ERCOT) have given up their right to control the supply of power,” said Gay. “They can’t demand that any particular party in our state build new generation capacity. We depend upon the market to do that.”

Gay and others doubt that another large project like Sandy Creek is likely to come on line any time soon.

Photo by Mose Buchele for StateImpact Texas

Kent Saathoff works on grid planning and operations for the Electric Reliability Council of Texas.

“Under the current structure of the competitive market, we need to have a market and market prices that encourage investors to invest in new generating plants,” said Kent Saathoff, who’s in charge of planning and operations for ERCOT.

But the current market does not favor that investment.

“Lower natural gas prices have essentially lowered the cost of electricity, which has made it less attractive for investors to build new generation in ERCOT, and so lower natural gas prices, while they’re certainly good in the short term, they certainly don’t incentivize new generation to be built in the state,” said Saathoff.

Supporters of deregulation remain hopeful, though, that innovation will bring the state out of its electricity crunch.

“If you compare this industry restructuring with what happened in telecommunications, it was in the early 80s that they started that process it wasn’t until the mid to late 90s that the Internet really took off and it was only recently that the internet has gone mobile,” said Stratus Energy Group’s Mark Bruce. “That same kind of change is possible with the way we use energy but its going to take time and investment to get there.”