Caption

Gene Perry / Oklahoma Policy Institute

Caption

Gene Perry / Oklahoma Policy Institute

Gene Perry / Oklahoma Policy Institute

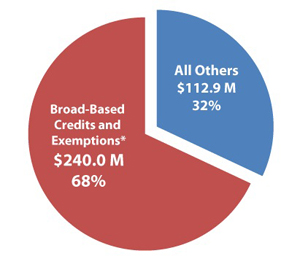

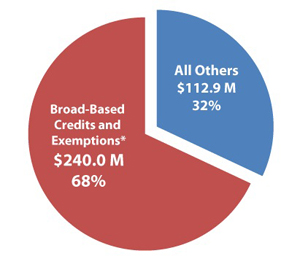

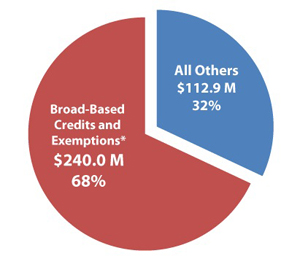

An analyst with the Oklahoma Policy Institute said two-thirds of the tax reform panel's recommended tax credit cuts are "broad-based" and would mean higher taxes for most Oklahomans.

Who will tax reform hurt more: corporate special interests or low-income seniors and families with children?

Sen. Mike Mazzei, who co-chaired the tax reform panel, said eliminating dozens of tax credits and “preference items” — to help pay for reductions to Oklahoma’s personal and corporate income tax — would be a blow to special interest groups.

Mazzei reiterated that point last week in a StudioTulsa interview with KWGS’ Rich Fisher.

But in a new blog post, The Oklahoma Policy Institute — which is leading a coalition to fight for the income tax — says the task force recommendation has twice as many broad-based cuts than cuts to corporate special interests.

Only one-third of the proposed cuts will affect corporate special interests, writes Gene Perry, a policy analyst with the Oklahoma Policy Institute. According to Perry’s analysis, the bulk of the cuts — 68 percent, or about $240 million — come from what he calls “broad-based credits and exemptions.”

The task force’s plan would raise taxes for most Oklahomans, Perry argues.

“It’s why the real losers under this plan are not corporate special interests; they are families with children and low-income seniors.”

We broke down the entire list of recommended credit cuts earlier this month, but here’s a look at the numbers behind Oklahoma Policy Institute’s argument.

| NAME | AMOUNT |

|---|---|

| Personal Exemption | $132,699,190 |

| Sales Tax Relief | $43,212,000 |

| Oklahoma Earned Income Tax Credit | $31,887,000 |

| Child Care | $28,991,000 |

| Oklahoma College Savings Program | $2,412,120 |

| Individuals Sixty-five (65) or older | $474,300 |

| Low Income Property Tax Relief | $226,000 |

| Blind Individuals | $130,722 |

| Total: | $240,032,332 |