Tuesday, April 8, 2014

TAG | Oklahoma Policy Institute

15 stories

Tuesday, August 27, 2013

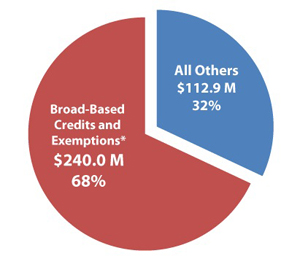

Study: Oklahoma’s Drilling Incentives Reduce Modest Oil and Gas Tax Rates

Tuesday, October 23, 2012

An Argument Against State Tax Breaks for Oklahoma’s Oil and Gas Industry

Monday, February 13, 2012

In the Income Tax Debate, ‘Growth’ Depends on How and What You Count

Tuesday, February 7, 2012

Four Things You Should Know About Gov. Fallin’s Income Tax Reduction Plan

Tuesday, January 17, 2012

Will Reform Recommendations Raise Taxes for Most Okies? The Numbers Behind OK Policy Institute’s Claim

Wednesday, January 4, 2012

Meet the Resistance: A Coalition to Fight for the Income Tax and State Services

More posts