Dartmouth-Lake Sunapee Snapshot: Burgeoning Start-Up Scene Wrestles With Recruitment Challenge

Amanda Loder / StateImpact New Hampshire

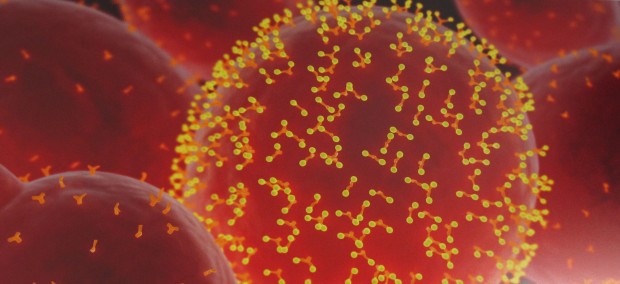

Upper Valley bioengineering start-up Adimab uses yeast to discover antibody-based drugs

Tomorrow morning on NHPR, we’ll hear from Tillman Gerngross, a bioengineering entrepreneur in the Upper Valley. Tillman’s story is Part Three of our series “Getting By, Getting Ahead,” examining how people across New Hampshire’s seven regions are navigating a recovering economy.

___

The economy of New Hampshire’s Upper Valley has two really big things going for it. One of them is Dartmouth College in Hanover. The other is Dartmouth-Hitchcock Medical Center in Lebanon. Thanks to these two research engines, this part of the Dartmouth-Lake Sunapee region sees new start-up companies launch each year in engineering, information technology and biotechnology.

But once those companies are born, the Upper Valley has something really big working against it: Cambridge, Massachusetts. Just over two hours away, and home to Harvard University and MIT, Cambridge has more of everything these companies need — venture capital, office space, a large workforce of Ph.D.s. and proximity to Boston. For many Upper Valley tech start-ups, moving to Cambridge is a natural and inevitable step toward sustaining themselves.

Entrepreneur Gregg Fairbrothers is a good example of the region’s dilemma. Fairbrothers is the founding director of the Dartmouth Entrepreneurial Network, a group dedicated to fostering the area’s start-up culture. He also helped launch a technology “incubator” for small companies that need office space in the area.

For all his Upper Valley boosterism, however, Fairbrothers may join the exodus of start-ups. Cognitive Electronics, a firm that he co-founded, specializes in creating software that can handle huge loads of data quickly and energy efficiently. Although Fairbrothers says he and his partners have yet to make a final decision, it looks like the workforce they’ll need is in the Boston-Cambridge area.

“A lot of [start-up] companies are moving out,” Fairbrothers says. “There’s no question that if you’re in the Upper Valley, you’re a long way from air transportation. You’re in a very shallow pool in terms of commercial-industrial activity, and that makes it very difficult to recruit the kind of talent you want.”

It isn’t just executives that feel Cambridge’s magnetic pull. Many of the people who would work for high-tech companies feel it, too. “In general, people are reluctant to go to a place where, if the company they’re going to doesn’t work out, they’re going to have to move,” Fairbrothers says. The concentration of tech companies in Cambridge makes it possible to find work quickly. “That isn’t going to happen in the Upper Valley.”

That’s not to say that start-ups don’t put down roots in the Upper Valley. After Hypertherm, which specializes in high-tech industrial cutting equipment, was founded in the late 1960s, it stayed in the area. A more recent start-up, the cellulosic ethanol firm Mascoma Corporation, remains committed to the region.

Dartmouth bioengineering professor and entrepreneur Tillman Gerngross also has been successful in keeping his companies nearby. In 2000, he co-founded GlycoFi, which developed a technology that used yeast for the production of therapeutic proteins that could be used to treat a range of human diseases.

One of the hardest parts about doing start-up work in the Upper Valley, he says, was investor pressure to move.

“In every round of financing, it’s not ‘Are you moving to Cambridge?’ The question was, ‘When are you moving to Cambridge?'” Greengross says. “And so there was continuous pressure of leaving New Hampshire and moving to a more traditional biotech hub.”

Gerngross actually began his career in Cambridge. He came from Austria to study at MIT, and then spent a few years working at a biotech company nearby. After landing a professorship at Dartmouth, Gerngross moved to the Upper Valley in 1998. He had a yen for innovation, but no desire to move back to Massachusetts; so he decided to stay put and find a way to make a biotech company survive here. In 2006, Merck bought GlycoFi for $400 million. The firm is still operating in Lebanon today.

For his part, Gerngross has since started another Upper Valley project, the drug discovery company Adimab. “And with Adimab, of course, that [pressure] never came up,” Gerngross says. “We’ve established ourselves, people that can build and run successful companies, even in sort of off-markets like New Hampshire. The question never came up again.”