TAG | Oil and Gas Incentives

9 stories

Wednesday, January 10, 2018

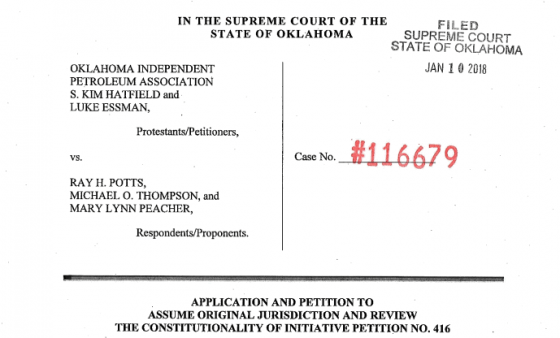

Industry Group Challenges Proposed Ballot Question To Raise Oil And Gas Taxes

Thursday, January 4, 2018

An Oilman Who Helped Write Energy Industry Tax Breaks Is Leading An Effort To Remove Them

Thursday, April 13, 2017

Energy Industry Divided as Public Calls to Increase Oil and Gas Taxes Grow Louder

Tuesday, November 22, 2016

As Lawmakers Prepare to Confront Budget Hole, Energy Execs Champion Prolific Oil Fields and Pro-Industry Incentives

Monday, September 15, 2014

Attorney Asks Oklahoma Supreme Court to Dismiss His Challenge to Oil and Gas Law

Thursday, May 29, 2014

What Became of the Bills StateImpact Was Watching This Legislative Session?

The Drought-Proof Communities Act couldn’t get through the House either, though the Senate did pass it.

Wednesday, July 17, 2013

Head of Foundation Built by Oil Riches Says State Doesn’t Need Drilling Incentives

Tuesday, October 23, 2012