A Guide to Internet Sales Taxes in Oklahoma: What’s at Stake, Who’s Behind it and Inside the Debate

-

Joe Wertz

Kevin H. / Flickr

Oklahoma lawmakers lament tax revenues lost on Internet sales, while brick-and-mortar retailers complain about their sales tax-free competition.

Business leaders and lawmakers in Oklahoma have been ramping up efforts to force Internet retailers to collect sales taxes for states and cities.

Here’s StateImpact Oklahoma’s guide to the issue, and the impact it has on key stakeholders and Oklahoma taxpayers.

Background

In Oklahoma, general sales taxes comprise about one-third of all state and local tax revenues, and cash-strapped state and local governments need all the tax revenue they can get their hands on.

Brick-and-mortar retailers and businesses add directly to state and local coffers by collecting sales taxes.

The Problem

Increasingly, consumers are buying on the Internet. Oklahomans spent more than $2.9 billion online in 2007, according to a 2009 University of Tennessee study (right-click here to download) that estimated the amount of e-commerce sales tax revenues lost annually by each state.

Generally, online retailers don’t charge sales taxes on Internet purchases.

Nationwide, Internet purchases are responsible for about a $23 billion deficit in state and local taxes, according to the Tennessee study.

Oklahoma’s cut of those losses? Between $185 million to $225 million, Oklahoma Tax Commission spokeswoman Paula Ross told The Oklahoman, citing figures from the study.

The Question

How do you collect sales taxes from a retailer that doesn’t have a physical presence in the state?

In general, you can’t. According to 1992 Supreme Court ruling concerning a catalog mail-order company, retailers can’t be forced to collect sales takes in states where they lack a physical presence. But, the court ruled, Congress has the authority to enact legislation requiring such retailers to collect use taxes.

And that’s just what lawmakers and business leaders in Oklahoma are pushing for.

Why is This so Complicated?

Each state has its own laws and statutory peculiarities, which poses a challenge for Internet retailers that don’t have a physical presence in the state.

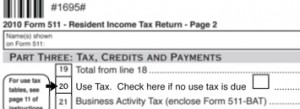

Joe Wertz / NPR StateImpact

Oklahomans are supposed to declare the amount of purchases from retailers that don’t collect state sales taxes on their state income tax form.

What’s on the Books?

Technically, taxes should be collected on Internet purchases. In Oklahoma and many states, taxpayers are required to self-report purchases made from retailers that don’t collect state sales taxes. This includes Internet and mail-order, catalog, phone, radio and television purchases.

But no one really does that.

What’s Being Done?

Oklahoma is among 24 states that passed a streamlined sales tax agreement. The agreement creates a detailed database helps Internet retailers find and apply the proper state and local taxes.

Last week, a bipartisan group of 10 U.S. senators co-sponsored the Marketplace Fairness Act, which would make it easier for states to collect sales taxes for online purchases made by their residents.

Oklahoma business leaders and lawmakers have joined the effort in Washington, D.C.

In a letter sent to the state’s congressional delegation, the State Chamber of Oklahoma called the current system unfair to brick-and-mortar stores, The Oklahoman reported.

And early this year:

Oklahoma City Mayor Mick Cornett told President Barack Obama at a White House meeting that he should get behind federal legislation to help cities get sales tax revenue; Cornett estimated Oklahoma City loses between $10 million and $15 million a year, The Oklahoman’s Chris Casteel reported.

Brick-and-mortar retailers are among the biggest backers of such efforts. In Oklahoma, the so-called “e-fairness” effort has picked up steam among local business owners who complain that Internet companies that don’t collect sales taxes have an unfair business advantage.

One Oklahoma retailer told nonprofit journalism outfit Oklahoma Watch that she’d had customers leave her store and actually voice their intention to buy online to avoid paying sales taxes.

Last year, Oklahoma’s State House defeated Senate Bill 744, which would extend the state’s involvement in a model based on the Streamlined Sales and Tax Agreement to collect taxes due from direct mail.

Not surprisingly, Internet retailers have resisted efforts to force them to collect taxes.

Amazon.com dropped local affiliates in Connecticut, Illinois and elsewhere this year, to protest attempts to impose the sales tax, which were justified legally because the company had a physical connection to the those states, writes The Atlantic’s Ted Mann.

Who Are Some of the Supporters?

- Local brick-and-mortar retailers, business leaders and the organizations — like the State Chamber — that represent them

- Some state lawmakers and influential municipal leaders like OKC Mayor Cornett and Norman Mayor Cindy Rosenthal

- Large retailers like Walmart, which has been hard at work lobbying Oklahoma Rep. John Sullivan, R-Tulsa, according to The Oklahoman

- Surprisingly, Amazon.com. Why the turnaround? According to The Atlantic‘s Mann, “The answer may be, simply, that it’s easier to follow one universal rule than 50 separate, arcane ones.”

And the Detractors?

- Some, mostly conservatives, reports Oklahoma Watch’s Ron Jackson — say that collecting Internet taxes is another way of saying “new tax.”

- Internet retailers like eBay

Is the Federal Legislation Going to Pass?

That depends on who you ask.

Sen. Lamar Alexander, R-Tennessee, says yes.

Oklahoma lawmakers aren’t so sure, reported The Oklahoman.

Sen. Tom Coburn, R-Muskogee, said it wasn’t a good time, economically, to add tens of billions of dollars to taxpayer purchases. Rep. James Lankford, R-Oklahoma City, told The Oklahoman it’d be tough to wedge the legislation onto the crowded agenda.

Rep. Tom Cole, R-Moore, had a different perspective for reporter Chris Casteel:

“In this political environment, I think it’s going to be tough because taxes are taxes.”