Internet Tax

[bill id=”HB 2586″ state=ok session=”2012″ align=right]

Business leaders and lawmakers in Oklahoma have been ramping up efforts to force Internet retailers to collect sales taxes for states and cities.

Brick-and-mortar retailers are among the biggest backers of such efforts. In Oklahoma, the so-called “e-fairness” effort has picked up steam among local business owners who complain that Internet companies that don’t collect sales taxes have an unfair business advantage.

In Oklahoma, general sales taxes comprise about one-third of all state and local tax revenues, and cash-strapped state and local governments need all the tax revenue they can get their hands on.

Joe Wertz / NPR StateImpact

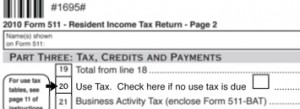

Oklahomans are supposed to declare the amount of purchases from retailers that don’t collect state sales taxes on their state income tax form.

Technically, Oklahomans are required to self-report purchases made from retailers that don’t collect sales taxes. Line No. 20 on the state income tax form asks Oklahomans to list “use taxes” from Internet, mail-order, catalog, phone, radio and television purchases.

Not surprisingly, few Oklahomans report such purchases.

Oklahoma could be losing between $185 million to $225 million, Oklahoma Tax Commission spokeswoman Paula Ross told The Oklahoman, citing figures from a 2009 University of Tennessee Study.