Pension Reform: Some Myth-Busters To Follow The Stalemate

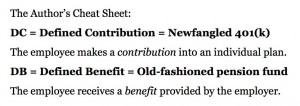

Last week, a State Senate bill that initially sought to replace New Hampshire’s defined benefit (DB for short — think pension) plan with a defined contribution plan (DC for short — think 401(k)) dissolved into a stalemate. The Senate and House were not even able to form a commission to make recommendations addressing the state’s $4.2 billion in unfunded liability. There seems to be an inability to agree on the facts. We mined a few sources, especially a report from the National Institute On Retirement Security (NIRS), to try to find some clarity.

People assume DC plans are cheaper than DB plans for employers, and therefore for taxpayers — when it comes to public pensions. But that’s not actually true. Economists agree that defined benefit plans are more efficient than defined contribution plans. There are three reasons.

People assume DC plans are cheaper than DB plans for employers, and therefore for taxpayers — when it comes to public pensions. But that’s not actually true. Economists agree that defined benefit plans are more efficient than defined contribution plans. There are three reasons.

- When an employer pools all of their employees’ investments and risks in a single pension fund, they can spread risk over the long term, saving in the good years and spending that in the bad years.

- The pooled investments also prevent over- and under-saving, which is what happens with DC plans because individuals can’t predict when they will die.

- DB plans have lower management fees because of what economists call “economies of scale.” Like buying anything in bulk, it’s cheaper to manage all of the money at once, rather than managing hundreds or thousands of individual investments.

Because of all of these factors, DB plans provide the same benefit for 46% less than the DC plan provides. Check out NIRS’s Figure 1.

So why have so many employers switched to defined contribution plans?

- Smoke and mirrors. According to research by economists Theresa Ghilarducci and Wei Sun, when employers switch out of DB and into DC plans, they almost always cut the average employee benefit in the process. So while the same benefit will be cheaper in a DB than in a DC plan for both the employer and the employee, employers are using the transition as an opportunity to cut overall benefits. That makes things cheaper for the employer, but not for the employee.

- Risk Divestment. Defined contribution plans, while less efficient, put all of the risk in the employee’s hands. While this may be good for savvy investors, it is not so good for your average employee. So while employers could get more bang for their buck with a DB plan, with a DC plan they move financial risk from the company to the employee.

Another perk to DC plans is that they are very mobile, something useful in an era of high employee turnover. But that’s actually a detractor for businesses: employee turnover is expensive, and the old-fashioned DB pension plans encouraged employee loyalty.

If traditional DB plans are so great, why are state DB pension plans — like New Hampshire’s — in so much trouble?

That seems to have less to do with the kind of pension fund, and more to do with the ways that states have been investing them. One problem is that states like New Hampshire haven’t been saving during the good times to prepare for the bad times. Instead they’ve provided bigger and better benefits in the good times, only to find they can’t sustain them during a recession.Another reason was recently laid out by Mary Williams Walsh and Danny Hakim in the New York Times. They explained that while most public pension funds are assuming an unrealistic 7 to 8 percent (New Hampshire assumes a 7.75 percent) rate of return on investment, today the realistic expectation would be more like 3 or 4 percent — individuals are only seeing 1 percent on their 401(k)s, afterall. But lowering the anticipated rate of return even three-quarters of a percentage point sends unions, taxpayers and voters into a tizzy. As the Times reported, “when Rhode Island’s state treasurer, Gina M. Raimondo, persuaded her state’s pension board to lower its rate to 7.5 percent last year, from 8.25 percent, the president of a firemen’s union accused her of ‘cooking the books.’”

As the Executive Director of the New Hampshire Retirement System George P. Lagos explained in a letter to Senate Majority Leader Jeb Bradley, the New Hampshire Retirement System Trustees have more than once supported a study commission and endorsed adequate funding for it, to better understand the issues surrounding a transition to a defined contribution plan, before committing the state to such a potentially expensive change.

An editorial by the Concord Monitor recently suggested that alternatives should be discussed, including hybrid plans that combine both DB and DC plans — a system supported by the National Institute On Retirement Security, the organization responsible for much of the information in this article.

Was this article helpful? Do you think we got it all wrong? Let us know. Leave a comment below, or send us a message on Facebook or Twitter.