Marcellus spurs wholesale gas price break at regional trading point

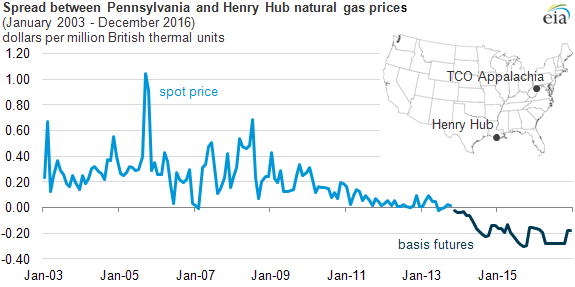

The growing supply of gas from the Marcellus Shale is set to push wholesale natural gas prices at a Mid-Atlantic regional trading point below the nation’s benchmark price beginning early next year, according to market projections.

Prices at a regional trading point in southwestern Pennsylvania known as TCO Appalachia are expected to dip lower than the benchmark Henry Hub price point in Louisiana in a shift from past trends.

According to the U.S. Energy Information Administration:

“Natural gas prices in the Mid-Atlantic have traditionally been more expensive than Henry Hub, reflecting the cost of moving natural gas from the production in the Gulf region to consumers along the east coast. Increased production from the Marcellus region began changing that relationship in 2011.”

Now, northeast consumers can get more of their gas from closer, plentiful sources in Pennsylvania, West Virginia and Ohio.

The EIA notes that recent growth in gas production in the region is mostly due to increased output from northeastern Pennsylvania wells that have been tied in to new or expanded pipelines. Northeastern Pennsylvania still produces most of the state’s Marcellus Shale gas, even though companies have been sending more of their drilling rigs to the “wet” gas regions of the Marcellus in southwestern Pennsylvania and West Virginia since early 2012.