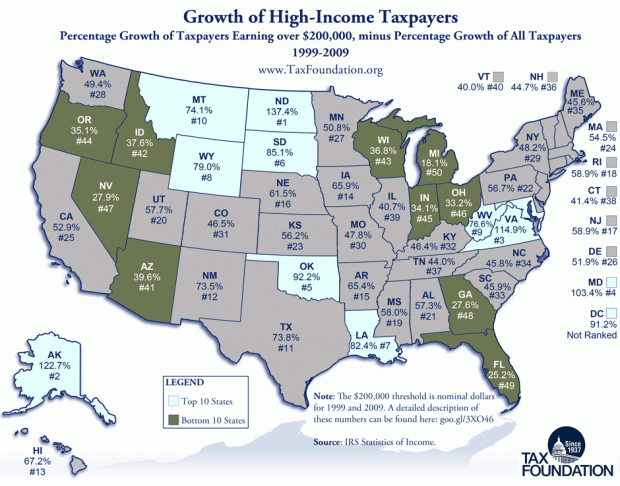

NH Lags Behind Most Of New England And New York In High-Income Taxpayer Growth

Here’s a new map from the Tax Foundation showing growth of high-income taxpayers from 1999-2009. What’s particularly interesting about these numbers is that they straddle pre- and post-recession years. So StateImpact naturally wondered, did the recession dramatically change where the high income bracket grew?

Not really.

Nick Kasprak is an analyst and programmer with the Tax Foundation. He collected the data from the IRS, studied it, and created the map. He says the changes overall were small. The possible exception is North Dakota, which has been the country’s big success story since the economic collapse, “If you’re looking only ’99 to ’04, it was ranked number six,” Kasprak says. “But if you look from ’05 to ’09, then it was number one. I don’t know the specific reason for North Dakota being [so] high growth…but they’re certainly growing very fast.” In other words, the state was already on the road to high growth, but those last five years saw a big spike.

It’s a very different story for the Northeast. From Maine to New Jersey, growth of the high-income tax bracket has been lackluster. Given New Hampshire’s lax tax policies, StateImpact was surprised to find that it ranks not only near the bottom in terms of national growth, but is also among the slowest-growing New England states. New Hampshire ranked No. 36. Only Vermont, at No. 40, and Connecticut, at No. 38, saw less high-income growth.

Kasprak says he was surprised by New Hampshire’s low ranking too, and so far has come up with two possible explanations. The first, he says with a hearty disclaimer, is “only speculation,” but, “New Hampshire is a place that people go to retire, and they’re not bringing in the same income, and that could be driving it down.” He points out that the “Retirement Effect” is a big factor in Florida’s No. 49 ranking. But Kasprak says there’s a strong basis for the second explanation of New Hampshire’s lackluster high-income growth. “I think with the Northeast, it’s more of a long-term trend, not necessarily in terms of the overall economy shrinking, but I think there’s a lot of people from the Northeast moving to other areas of the country. There’s just this general Northeast to Southwest movement, in terms of migration patterns.”

One more thing to keep in mind about these numbers: They’re the nominal high-income tax payers as determined by the IRS. Nothing’s been adjusted for inflation, which, Kasprak says, is why you see respectable growth in even the low-ranking, long-depressed Rustbelt strongholds like Michigan, Ohio and Indiana.

Nick Kasprak / Tax Foundation

New Hampshire and the Northeast in general lag behind other areas of the country in terms of high-income taxpayer growth.

Ed. Note: In an earlier version of this story we incorrectly spelled Nick Kasprak’s name as “Kasperak.” We regret the error.