Best Of StateImpact: How A European Recession Could Hurt Key Export States–Including NH

Dennis Skley / Flickr

How much could a Eurozone recession hurt New Hampshire? We look into it after the jump

A good-sized chunk of New Hampshire’s economy depends on its manufacturing sector–especially the fabrication of high-tech products and components. And a lot of that stuff gets exported. Now, with increasing chatter about a possible European recession, we thought it would be a good time to re-post our explanation of how, exactly, Eurozone troubles could affect the state’s economy.

***

Recently, Wells Fargo Securities released a short report offering a state-by-state look at the places that could be hardest-hit by a potential European recession. Since New Hampshire has carved out a healthy niche for itself in the high-tech components export market, we thought this report might be of interest to our StateImpact readers.

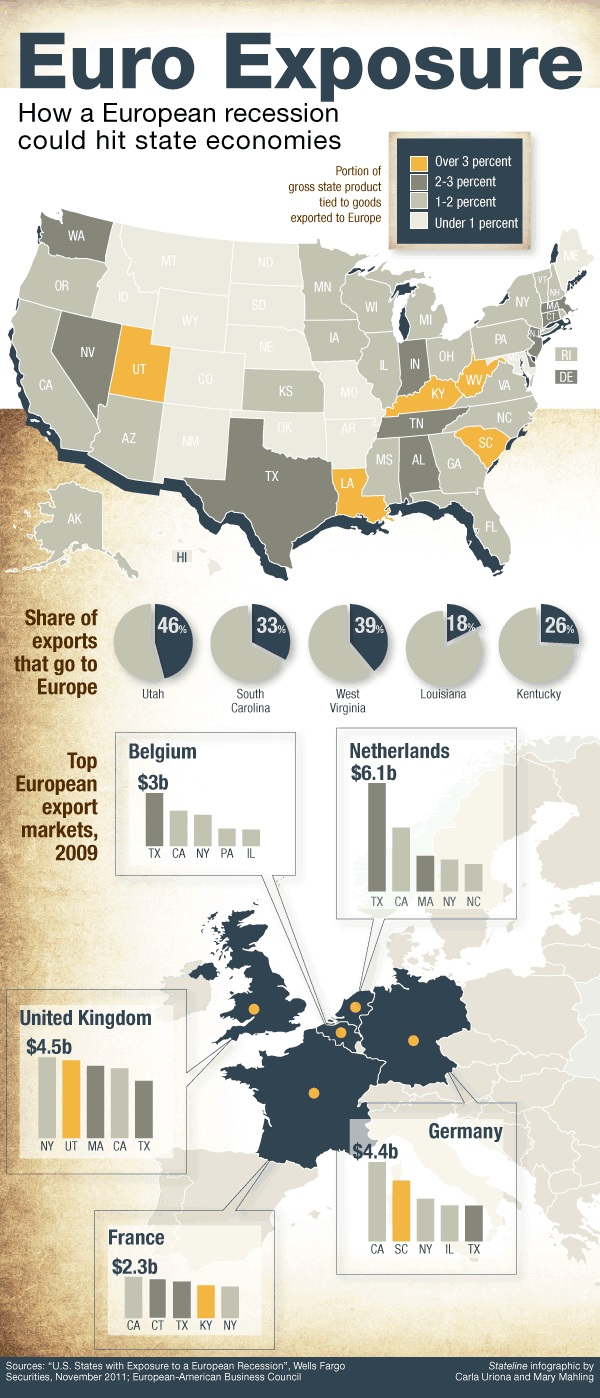

For its analysis, Wells Fargo looked at each state’s exports to Europe by percent of GDP, and then ranked them on a scale of highest-to-lowest risk. Among the report’s key findings are:

- Only 1.97 percent of overall US GDP is made up of exports to European markets.

- States with the highest exposure to a possible European recession primarily export commodities. For example, Utah, with its gold and silver exports, and West Virginia, which sends coal across the Atlantic, depend much more heavily on European markets than many other states. More than 5.5 percent of Utah’s GDP is tied to European exports, and 3.9 percent of West Virginia’s GDP is tied to those markets.

- States exporting automobile and aerospace parts and/or high-tech components tend to fall into the “highest risk” or “high risk” categories. High-tech bastion Massachusetts is among the “highest risk” states, with more than 2.8 percent of GDP is made up of European exports. Meanwhile New Hampshire, with its related high-tech components industry, is considered a “high risk” state. European exports comprise nearly 1.9 percent of the Granite State’s GDP.

- There’s no one geographic area that’s hit harder than all the others. “Highest risk” states are spread out over New England, the South, Midwest, and West.

- If there’s a short, shallow recession in Europe, the the key to determining the effect on states will be their trading partners. Northern European countries, although struggling, are generally not hurting to the extent of Portugal, Italy, Ireland, Greece and Spain (aka: the “PIIGS”). So states trading with more northerly (or, more specifically, non-PIIGS) countries might not be hit as hard.

- If there’s a long, deep European recession, it could get a lot worse for states. In the event of a longer-term recession, those northern European countries would be more heavily exposed to the crisis. That strain across the continent could in turn touch on other exporters to Europe, like China and Brazil. And with their key trading partners–and ours–deeply hurting, Wells Fargo analysts write, “Such a scenario would then have an effect on virtually all states.”

If you’d like to read the whole report from Wells Fargo Securities, you can check it out here. Among other things, analysts have created a map showing how much of each state’s GDP is comprised of exports to European markets.

Meanwhile, for overarching context, we’d like to point you to some great graphic work by Carla Uriona and Mary Mahling of Stateline. We’ve posted their Euro Exposure infographic below. It color-codes states according to risk level, and also shows how much key states, including Massachusetts and Connecticut, rely on major European markets.