Wolf says Act 13 language should be fixed to protect impact-fee revenue

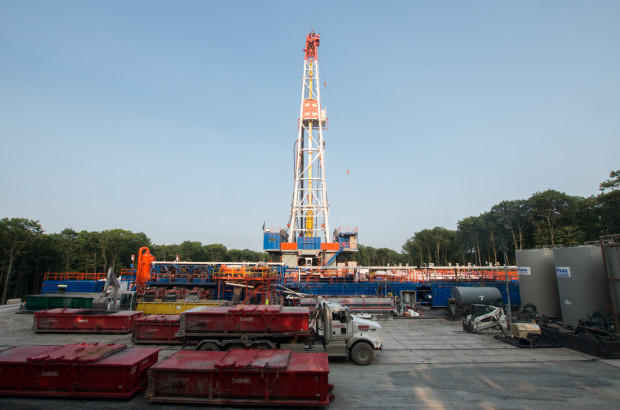

Joe Ulrich / WITF

The PUC is challenging a court ruling that it says would further reduce impact fee revenue which has already declined because of a decline in gas production..

Pennsylvania Gov. Tom Wolf said late Wednesday that the wide-ranging Act 13 law should be changed to ensure that municipalities receive all the revenue they are entitled to from the state’s impact fee on gas drilling.

Wolf’s office issued a statement in support of the Public Utility Commission which said Tuesday that the law’s language should be changed so that drillers cannot escape paying the fee on low-producing gas wells. The regulator also said it would appeal a recent Commonwealth Court ruling that would limit the fees payable on the so-called stripper wells.

“As a result of the recent court decision, counties and municipalities across the state which receive impact fee revenues to address critical infrastructure needs and impacts of natural gas development will receive millions less this year and in future years,” the statement said. “The Governor believes that the language should be fixed to ensure that counties and municipalities receive the funding they depend on.”

Wolf said the court ruling also shows the need for a severance tax on gas production, which he continues to press for despite opposition from the Republican-led legislature.

PUC chair Gladys Brown wrote to Wolf on Tuesday, saying the ruling could “significantly jeoparidize” current and future fees paid by the industry. She argued that last month’s ruling was inconsistent with Act 13 that set up the impact fee, and would accelerate recent declines in revenue from the fee paid by producers.

The PUC, which administers the fee, has argued that it is payable on stripper wells if they produce at least 90,000 cubic feet of gas a day for any month of the year, based on the Act 13 definition of a stripper well as one that is incapable of producing more than 90,000 cubic feet of gas a day during any calendar month.

That’s at odds with the court’s ruling that Snyder Brothers, a Kittanning-based gas driller, had to pay the fee only if the wells’ output exceeded the 90,000 cubic-foot minimum on every month of the year.

The ruling followed a lawsuit against the PUC by Snyder and the Pennsylvania Independent Oil and Gas Association (PIOGA). The association’s general counsel, Kevin Moody, responding to the PUC’s letter, said the commission had used a different standard in arguing its case to the court than it had in any of its orders implementing the impact fee.

Moody predicted the PUC will lose its appeal. “I’m confident that the PUC’s attempt to make this case into something else — about fears and notions of unlawful behavior by producers, completely without support in the record — will fail,” he said. “I look forward to responding to the PUC’s appeal request.”

Revenue from the fee has dropped in recent years as the low price of natural gas has curtailed drilling, reducing the number of newer wells that produce the most revenue.

A report from Pennsylvania’s Independent Fiscal Office estimates that fee revenue will drop to $174.6 million this year, 23 percent lower than its peak three years ago. The fees have brought in more than one billion dollars since 2011.

The revenue decline is hurting many municipalities, especially smaller ones, that have come to depend heavily on the fee since the law’s enactment in 2012, according to a report by Moody’s Investors Service in February.

Pennsylvania is the only major energy-producing state that does not tax gas production with a severance tax, opting instead for the impact fee which is levied per well, and is designed to compensate municipalities for local costs associated with gas production.

The ruling would lead to more declines in impact-fee revenue, and would have an “unreasonable” result that is at odds with the intent of the 2012 law, the PUC’s letter said.

“The court’s interpretation will cause impact fee collections to decrease, since more wells will now be exempt from the fee,” Brown wrote. She projected that revenue from the fee will decline by 10 percent, or $16 million, this year, and the falloff will accelerate as more producers take advantage of the court’s ruling.

Explaining her argument that the ruling was “unreasonable,” Brown said it would mean that a well that produced 100,000 cubic feet of gas a day for 12 months pays the fee while another that produced 200,000 cubic feet a day for 11 months and then fell below the minimum level for just one month would be exempt.

Brown said the PUC will ask the Pennsylvania Supreme Court to allow an appeal of the Commonwealth Court ruling.

Spokespeople for the majority Republicans in the Pennsylvania legislature did not immediately respond to requests for comment on the Governor’s call for a change to the Act 13 language.

Susan Phillips contributed to this report.