Corbett Mulls Lifting Cap On Gasoline Tax

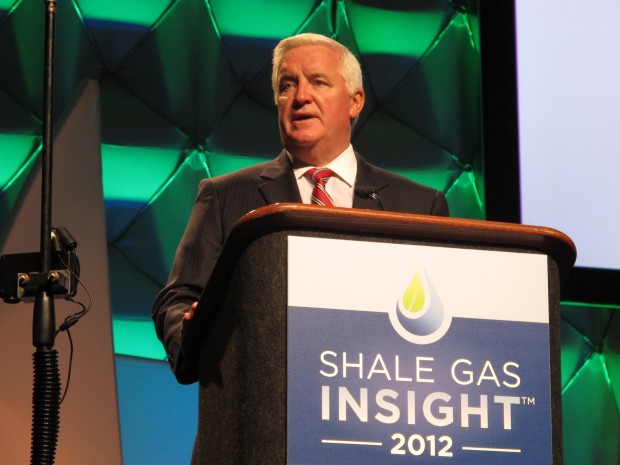

Scott Detrow / StateImpact Pennsylvania

Governor Corbett speaks to a Marcellus Shale Coalition conference in September

During the first two years of his tenure, Governor Tom Corbett has acknowledged Pennsylvania faces a major transportation and infrastructure problem, but has done little to address it. He created a Transportation Funding Advisory Commission, but kept its findings at arms-length, after the group recommended a mix of tax and fee increases to pay for road repairs.

That may change soon. Corbett opened up on the transportation funding issue during an interview with members of the Capitol press corps this week. Speaking in his office, Corbett indicated he’d be willing to lift a cap on Pennsylvania’s Oil Company Franchise Tax to help fund repairs.

The tax of 153.5 mils is currently applied to the average wholesale price of gasoline and diesel — up to $1.25 a gallon. As the commission stated, “The actual [average wholesale price] is now more than double the ceiling. Removing the ceiling would significantly increase revenue to PennDOT,

municipalities, the Pennsylvania Turnpike Commission, counties, and the Department of Conservation and Natural Resources.” Up to $1.4 billion more, in fact.

So what does Corbett think? The Post-Gazette reports:

Asked whether lifting the cap would violate his pledge against tax hikes, the governor responded that the cap is “artificial” because the Legislature decided “somewhere along the line” to stop the levy at $1.25 per gallon.

“If we do that, I think you’ll hear both sides, but I will tell you this: It’s an artificial cap,” Mr. Corbett said.

…”We’re looking, and we will come out with something relatively soon, before the budget, on transportation,” Mr. Corbett said. “Everything that’s in the transportation [report] is on the table with us right now.”