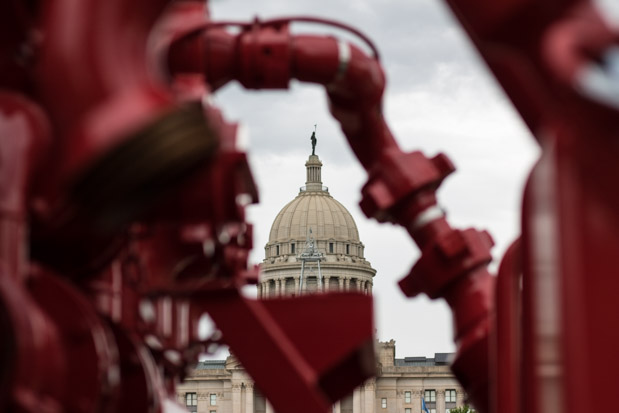

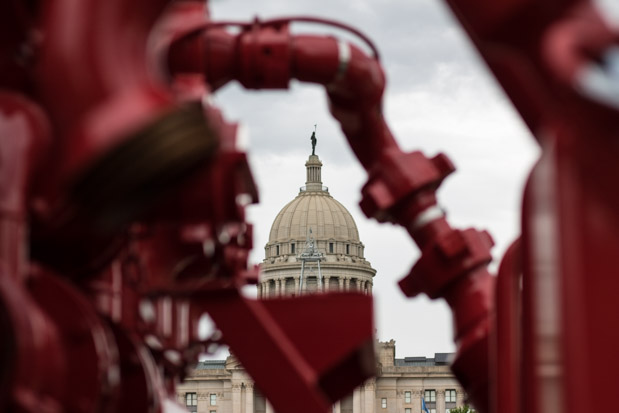

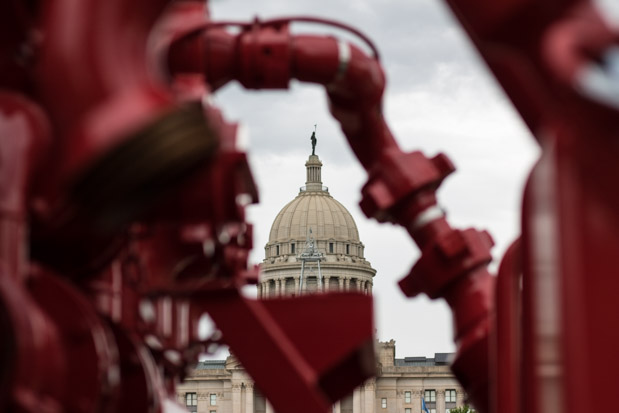

Service companies parked oil-field trucks and other equipment at the state capitol in a public demonstration as legislators debated a measure that would effectively increase taxes some oil and gas producers pay.

Joe Wertz / StateImpact Oklahoma

Service companies parked oil-field trucks and other equipment at the state capitol in a public demonstration as legislators debated a measure that would effectively increase taxes some oil and gas producers pay.

Joe Wertz / StateImpact Oklahoma

Joe Wertz / StateImpact Oklahoma

Service companies parked oil-field trucks and other equipment at the state capitol in a public demonstration as legislators debated a measure that would effectively increase taxes some oil and gas producers pay.

Oklahoma lawmakers have struggled for months to agree on a formula to patch a nearly $900 million budget hole and sign off on a plan that funds state agencies. To help pay for the budget plan, lawmakers are considering ways to squeeze more from taxes on oil and gas production, an option that has divided politicians and one of the state’s biggest industries.

Throughout the legislative session, demonstrators and educators rallied to urge lawmakers to raise oil and gas taxes. The energy industry responded in force, parking oilfield trucks and other equipment in the Capitol parking lot as a visual reminder of the industry’s importance and influence. Companies bussed in hundreds of workers to push lawmakers away from additional taxes on oil and gas producers.

Oklahoma levies a 7 percent tax on oil and gas. Many producers aren’t paying that rate, however, because the state has various incentives and discounts on the books. Newly drilled wells are taxed at just 2 percent for the first 36 months of production, for example. Other incentives, which are set to expire in coming years, mean some wells pay discounted taxes of 4 percent or 1 percent.

Throughout the 2017 legislative session, Republicans and Democrats have suggested various ways to change the terms of those incentives and discounts without changing the actual gross production tax rate. By using this tactic, Republican lawmakers say gross production legislation isn’t “revenue-raising,” which means it can be approved with a simple majority rather than the three-quarters supermajority constitutionally required of measures that raise taxes. Hardline Republicans have opposed many revenue-raising efforts, which means supermajority approval is impossible without Democratic votes, but negotiations between the parties stalled on this and other measures.

House Republicans are rallying behind HB 2429, which is advancing and changes the gross production discount for wells currently taxed at 1 percent, increasing the rate to 4 percent for the first 48 months of production. About 5,700 wells would be affected, and it is likely to generate $95 million in revenue, $74 million of which would be directed to the General Revenue Fund, according to the bill’s fiscal analysis.

Joe Wertz / StateImpact Oklahoma

A demonstrator holds up seven fingers to send a message to a House committee that lawmakers should remove discounts and incentives so all oil and gas wells are taxed at 7 percent.

Whether or not HB 2429 is designated a “revenue-raising” measure, the legislation effectively increases revenues from gross production taxes. Democrats like House Minority Leader Scott Inman called the effort a “gimmick” and suggested a state court would deem the legislation unconstitutional.

“It will blow an enormous hole in an already difficult budget time, and force us back into a special session to waste more of the state’s taxpayer dollars to do what we should have done in the regular session,” Inman said at a press conference this week.

Some conservatives questioned the legislation’s constitutionality, too. “I’m just not sure,” said Jason Murphey, R-Guthrie. “It seems very likely that an oil company might file a lawsuit and fight this.”

Other evidence suggests the gross production legislation — among others considered this session — could draw a legal challenge. Legislators in 2014 employed a similar tactic to re-up and reconfigure sunsetting gross production tax discounts, eventually settling on a bill that increased the effective rate for many producers from 1 to 2 percent. A lawsuit challenging the constitutionality was filed and heard by the Oklahoma Supreme Court, but was ultimately withdrawn.

At a disjointed midnight committee hearing on budget legislation this week, Republican Leslie Osborn, chair of the powerful House Appropriations and Budget Committee, acknowledged discomfort with the tactic, but said her party was forced to find a workaround when negotiations with Democrats broke down.

“We’ve had to be rather creative and find new legal manners that we could run these bills,” she said.