New pipeline could mean tax bonanza for NJ towns, but for Pa.? Not so much

Katie Colaneri/StateImpact Pennsylvania

Joe Kulick is township manager of Durham, Pa., one of 27 towns along the main route of the PennEast pipeline.

As Republican legislative leaders and the natural gas industry unite to beat back Gov. Tom Wolf’s severance tax proposal, here’s something lawmakers in Harrisburg are not talking about: Companies building new pipelines to grow markets for Pennsylvania’s natural gas don’t have to pay local property taxes on those lines to counties, towns and school districts.

So how much could local communities be missing out on?

In one case, StateImpact Pennsylvania has found that a proposed pipeline that would run beneath the Delaware River, the undulating boundary between Pennsylvania and New Jersey, could mean millions of dollars a year in new property tax revenue for towns in the Garden State. But on the other side of the river, Pennsylvania could be leaving millions of dollars a year on the table.

Two towns, one river, one pipeline

Delaware Township in western New Jersey stretches out from the banks of the Delaware River into rolling fields. Silos, big red barns and horse farms dot the landscape.

“Just a beautiful little gem of a township that represents what rural New Jersey used to be like,” said Jim Borders, who has lived here for 18 years. He’s proud his township is home to the last surviving covered bridge in New Jersey.

Delaware is one of 27 towns along the main route of the proposed PennEast pipeline, which would stretch more than 100 miles to bring natural gas from Northeast Pennsylvania’s Marcellus Shale to customers on the East Coast.

In Delaware Township, that could mean about $380,000 a year in new property tax revenue, according to tax assessor Michelle Trivigno.

Katie Colaneri / StateImpact Pennsylvania

Delaware Township, NJ is one of 27 towns along the route of the proposed PennEast pipeline.

In her office on the second floor of the historic township building, Trivigno crunches the numbers. She starts with the number six, which is about how many miles of new, 36-inch pipe could pass through Delaware if the PennEast pipeline is built in 2017.

With a few taps on her calculator, she estimates the township could receive about $54,000 a year. She’s basing that on the assessed value of the pipeline according to the Marshall & Swift cost estimating service.

The rest of the annual haul would be split up among the county, the schools and open space funds.

For a township with an annual budget of about $4 million, “it’s significant,” Trivigno said.

Remember: That $380,000 a year is for just six miles of new pipeline in one town.

Based on 2014 tax rates, a StateImpact Pennsylvania analysis found the project could bring in an estimated $2.2 million a year for the six New Jersey towns that lie in the PennEast pipeline’s path.

But on the Pennsylvania side of the river, most local governments won’t be seeing any new property tax revenue.

Unlike New Jersey, Pennsylvania law does not consider pipelines to be permanent property like a factory building. Rather, the state treats pipelines like the equipment and machinery inside the factory — those are not taxed.

“Basically, we have no benefit whatsoever,” said Joe Kulick, the manager of Durham Township in Bucks County.

Durham looks a lot like Delaware Township, with big old barns, rolling fields and residents who are fiercely proud of its history.

Here’s another thing these two towns have in common: They don’t want PennEast to come through and they’re making their case to the Federal Energy Regulatory Commission, the agency that will have final say sometime in 2016 on whether the pipeline gets built.

Back on the New Jersey side of the river, Jim Borders believes most residents like him are willing to do without the new tax revenue.

Borders, the township’s open space coordinator, says Delaware has spent more than $8 million dollars to preserve farmland from development since the 1980s. Some of those farms are in the path of the pipeline.

“Other people are going to be making tons of money off of this and we’re going to have to put up with the disruption,” he said. “It’s not going to be something that’s really going to benefit this township.”

Susan Phillips/StateImpact Pennsylvania

A sign opposing the PennEast pipeline in Durham Township, Pa.

Pennsylvania missing out on millions

Borders acknowledges Delaware Township is lucky it can afford to forgo that revenue. It sits in Hunterdon County, which is consistently ranked among the wealthiest counties in the United States.

But if the PennEast pipeline is approved, will towns like Durham in Pennsylvania get the short end of the stick?

StateImpact Pennsylvania found that if the state did collect property taxes on pipelines in the way New Jersey does, the 21 towns that sit over PennEast’s main route could collect an estimated $4.3 million a year, based on the most recent information available. Please see the end of this story for more details about our analysis.

The 1.5 mile stretch of pipe through Durham would bring in about $52,000 dollars a year for the township.

Bear Creek Township, Luzerne County could see about $565,000 dollars a year in property tax revenue on 10.4 miles of pipeline. The township has an annual budget of about $680,000.

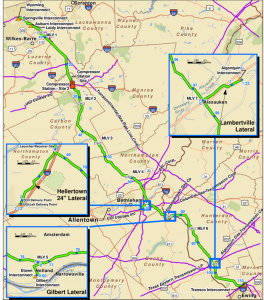

Courtesy of PennEast Pipeline LLC

A map of the current preferred route of the PennEast pipeline as of June 2015.

Backers of the PennEast pipeline say you can’t limit a calculation of its local benefits to property taxes. To them, the fuller picture includes jobs and lower energy costs.

“The pipe is being built because it will reduce the cost of natural gas and electricity to eastern [Pennsylvania] and New Jersey consumers,” said Pete Terranova, who heads up the consortium of companies behind the $1 billion project.

PennEast also claims the project will employ thousands of workers who will pay millions in income taxes to both states during the construction phase.

But Penn State economist Tim Kelsey says the benefits of pipelines for local communities are often over-stated and don’t last long.

“Overall, there’s generally very little local economic impact of a new gas pipeline going through a community,” Kelsey said.

Construction jobs are by nature only temporary and often go to people who don’t live in the immediate community.

Plus, like many companies working in Pennsylvania, PennEast is registered in the state of Delaware, which means it can take advantage of a loophole in state law and avoid paying the full amount on sales and corporate income taxes.

Kelsey notes new pipelines can even end up costing local governments money if they opt to hire professionals to guide them through the approval and construction processes.

Back in January, Durham Township hired a geological consultant to the tune of $130 an hour.

Delaware Township recently set aside $15,000 in its annual budget to hire expert witnesses to testify against the pipeline at future hearings.

Susan Phillips/StateImpact Pennsylvania

Township manager Joe Kulick wants to use grant money from the PennEast pipeline company to restore the 195-year-old Durham Gristmill.

“We’re going to be severely impacted”

Two state senators from Pennsylvania are working on a bill that would place an impact fee on pipelines similar to the one the state charges on natural gas drillers. Since 2011, the impact fee has brought in $853.5 million to communities hosting wells.

State Sen. John Rafferty (R-Chester), one of the bill’s co-sponsors, said the pipeline-building boom is putting new burdens on towns hours away from the nearest gas well. The U.S. Energy Information Administration estimates Pennsylvania could see another 4,600 miles of new interstate pipeline built in the next several years.

“We’re going to be severely impacted here for years to come with installation of these lines,” Rafferty said.

His bill was referred to a senate committee in early March.

In the meantime, companies like PennEast have tried to sweeten the pot by offering grants to communities along the pipeline’s route.

Durham Township applied for one and got a check in the mail for $5,000, more than a month after the company announced the grant award in a press release.

Katie Colaneri/StateImpact Pennsylvania

A hole in a window frame at the 195-year-old Durham Gristmill.

Joe Kulick, the township manager, wants to use the money to help fix up Durham’s 195-year-old gristmill. He points to rotting beams and cracked window panes held together with duct tape.

“Could easily spend $5,000, not even blinking an eye,” he says.

The local ambulance squad recently applied for another $5,000 grant. It’s a fraction of what the township would receive in property tax revenue, but Kulick says it’s better than nothing.

Property tax revenues lost in Pennsylvania towns

Sources: PennEast Pipeline LLC; County websites; CSVRealtors.com; Newpa.com; Marshall & Swift cost estimating service.

Note: StateImpact Pennsylvania used an estimated assessed value of $2,317,392 per mile of new, 36-inch pipeline. That number is based on our interpretation of the Marshall & Swift cost estimation with guidance from a tax assessor and a real estate appraiser familiar with the service. Our property tax analysis is based on 2015 local millage rates adjusted for each county’s 2013 “common level ratio.” In Pennsylvania, this ratio of assessed to market value is calculated county by county each year. The 2013 ratios are the most recent ones available from the State Tax Equalization Board.

Kidder Township, Carbon County has two different school district millage rates. StateImpact Pennsylvania used the lower of the two millage rates in Kidder Township North for this analysis.