Background

As of early Wednesday morning, Ballot Question 1 has not received the super majority it needed to become law. However, with 57 percent of the vote, supporters will have sent a strong message to legislators that support for an amendment exists, and New Hampshire’s historical aversion to an income tax remains.

Question No. 1 explicitly forbids the Legislature from imposing any new taxes or fees on personal income.

Background:

According to the New Hampshire Department of Revenue, New Hampshire “does not have a general sales tax or an income tax on an individual’s reported W-2 wages.”

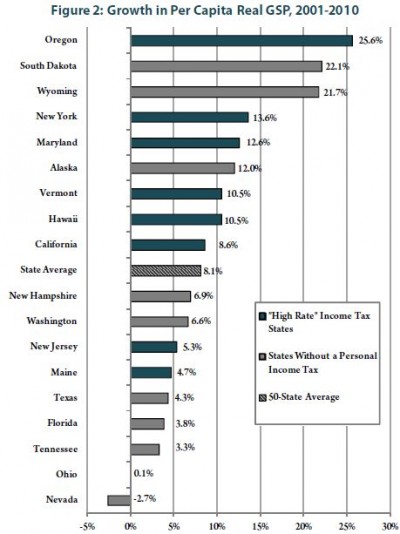

New Hampshire is the only state in the Northeast that does not tax personal income. Other states that do not levy an income tax on residents are Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming.

The New Hampshire House of Representatives voted 257-101 to refer the amendment to the ballot on Jan. 18, 2012. The measure was passed by the New Hampshire State Senate by a 19-4 vote.

What supporters say:

The lack of both an income tax and a sales tax gives New Hampshire a competitive advantage over other states that impose such taxes to fund government services. The amendment would enshrine the “New Hampshire Advantage” in the state’s constitution and ensure that future legislatures do not impose an income tax in response to short-term economic needs or political whims.

What opponents say:

The measure would tie the hands of future policymakers, who would be required to pass another constitutional amendment before levying an income tax to increase revenue. New Hampshire already relies heavily on property taxes to fund government services. Prohibiting a tax on personal income could lead to higher property taxes, as well as increases in other state and local taxes that have a greater impact lower-income residents.

The amendment itself:

Are you in favor of amending Part 2, Article 5-b of the New Hampshire Constitution by adding Article 5-c?:

Notwithstanding any general or special provision of this constitution, the general court shall not have the power or authority to impose and levy any assessment, rate, or tax upon income earned by any natural person; however, nothing in this Article shall be construed to prohibit any tax in effect January 1, 2012, or adjustment to the rate of such a tax.

A YES vote means you approve amending the state constitution to forbid an income tax.

A NO vote means you reject the proposed amendment.

Read more about New Hampshire’s 2012 General Election at NHPR.org