Governor Tom Corbett says the impact fee is still the best deal for Pennsylvanians

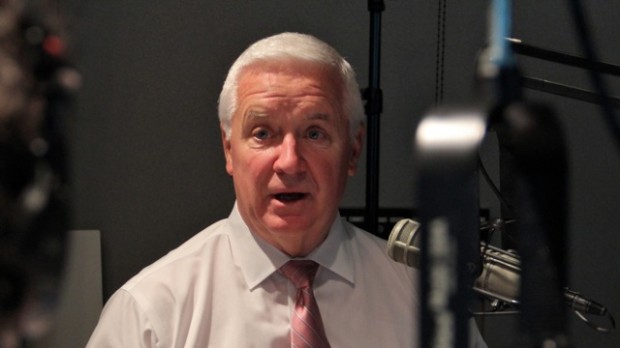

Governor Tom Corbett speaks about taxing the Marcellus Shale in an interview at WHYY in Philadelphia

StateImpact Pennsylvania’s Susan Phillips sat down with both candidates for governor and pressed them on energy issues. The candidates visited WHYY in Philadelphia, where several reporters interviewed them for about ten minutes each. Wolf has proposed taxing the Marcellus Shale gas differently than Governor Corbett. Wolf wants to charge a 5 percent tax on the market value of the gas at the wellhead. This is called a “severance tax” or some call it an “extraction tax.” Corbett wants to stick with the current impact fee, which charges a flat fee of $50,000 a well. The following is the transcript and audio of StateImpact’s interview with Governor Tom Corbett, edited for time and clarity.

Q: Governor, one of the things I’m hearing from voters, not just on my 200 block of Mountain Street in South Philadelphia but my cousins up in Altoona, Democrats, Republicans, middle class, working class, is we have this problem with education funding, why isn’t the governor enacting an extraction tax? And I know that you’ve said a number of things, we have a (high) corporate income tax, which Texas doesn’t have. We have an industry that could actually pull up stakes and move somewhere else if the combination of the regulations and the taxes don’t make it profitable enough for them. Can you give me an example of a time where the gas industry didn’t make their margins in a particular state, and so they packed up and moved elsewhere?

A: If you take a look at Louisiana and if you take a look at Alaska the drillers have reduced their activities. The oil companies have reduced their activity when the taxes were too high. And in fact, I understand from a number of people that Alaska saw the oil companies go away or reduce their activity and so offered them tax incentives now to come back. In Louisiana the same thing happened down there. Because they are going to go where they’re going to get the best return on their investment, where the margins are small. Because the investment of drilling a well is quite an expensive investment. The commodity that is very rare is the drill. There’s value in gas, there’s greater value in the permit, and there’s even greater value in the drill that goes and gets (the gas). And we want to keep the drills here in Pennsylvania.

A: I will tell you we’ve gotten $636 million in impact fee in three years. If you remember when Ed Rendell was governor the last couple years he said if we put a 10 percent tax on it we would get $100 million dollars. Well we didn’t put a ten percent tax on it. We put an impact fee on it because it does have an impact into the community and in the first year we received $223 million, twice as much as what was predicted.

Q: Right but have you done an analysis of what the corporate taxes have been since then?

A: The total amount of taxes that have been paid by the industry and by all the companies that work within the industry, if you’re talking about the industry as the drilling companies, they’re one part. But they are supported by many many smaller companies for instance you probably heard me talk about the young man who came up to me a couple weeks ago in Wyoming County and said 5 years ago I was driving a truck by myself and today I have 168 people driving trucks, driving water, to and from the drill sites delivering water. So overall that’s part of the industry, the support side the logistic side are part of the industry. The total amount is $2.5 billion dollars since 2008 that have been paid in.

Q: And you’re including not just the Marcellus Shale drillers, you’re including the…

A: We’re including everything that touches upon the industry, the support side of the industry. Because if the support side isn’t there the drillers aren’t there.

Q: Right, but have you just narrowed it down to the drillers, that’s what I want to know because that way you could compare apples and apples, what’s happening in Texas, what’s happening in Pennsylvania.

A: I don’t recall that we have.

Q: Okay.

A: What I know is we have $2.5 billion that has come in (since 2008) and on top of that you put in over $636 million in impact fee at this point in time. But it’s very hard because in Texas, they don’t have a personal income tax. And all those small businesses we have in Pennsylvania run on a personal income tax, tax method. They don’t have that in Texas. It’s completely different.

Q: My question is then, given I’ve been told by Shell executives there is no more profitable business than oil and gas extraction. So what I want to know is, from the voters point of view, how can you make sure that Pennsylvania residents are getting, and I realize there’s a line to dance here, but how can you make sure that they’re getting just as much of a benefit in these tax revenues as say residents in Texas or residents of Oklahoma?

A: Look at the increase in jobs. Over 30,000 jobs during that period of time, directly in the industry. We’ve put people back to work. Look at the cost of energy in Pennsylvania, it’s down 40 percent over the last ten years. A great deal of that is attributable to natural gas. Look at the plans that Philadelphia Energy Solutions has to bring natural gas to their facilities and to start building an ethylene cracker there. So you have to look at a much broader picture than dollar for dollar here and there. It’s an old industry that’s returned to Pennsylvania, right, because it started in Pennsylvania. But you’re fighting in the very beginning to build the infrastructure to that industry.

A: There’s three phases of the industry, drilling and discovery, distribution, and what’s distribution – building the pipelines all across Pennsylvania. And there are thousands of people right now employed in that. And then finally there’s developing markets. We don’t have the markets the way we’ll have them five or ten years from now, and that’s exactly what we’re working on. What I have said before is if you get four or five, ten years down the road than you can go back and reevaluate exactly how you want to tax this industry. But when they’re just getting started in Pennsylvania and we’re competing for the drill rigs, and that’s what we’re competing for, we’re competing for those drill rigs. And there’s new finds for instance back in Texas, back in the Eagle Ford (shale) to the southeast of San Antonio Texas, where the drill rigs if they leave Pennsylvania they’re not coming back for a long time until the price of that gas, that natural gas goes up. And if you’ve been following this closely you know that the price of natural gas, dry natural gas, is very very low. Up in the northern tier of Pennsylvania, we don’t have nearly as many rigs up there now as we had even five, six years ago because of the cost differences. So if you raise their costs at this stage, once we get past this stage…

Q: So let me ask you this then, we have this plan to export, FERC just approved the Cove Point plant (to export liquefied natural gas from Dominions terminal in the Chesapeake Bay), Cabot Oil and Gas has a contract (to supply gas to the Japanese company) Sumitomo, once the export market starts to kick in…

A: Then I think you can take a look at it. Then I think you come back and say now is the time to change, we have the industry established here they’re not going to go away once they get the vast majority of wells drilled, because that’s what we’re fighting for is getting them drilled, because once they get them drilled the gas is going to be coming out of the ground, it’s going to be capped, but then it’ll go into the transmission system. In fact I’ve been talking to people, maybe the tax, instead of being at the wellhead, should be in the transmission lines, the transmission of it. Now we can probably only tax it in the transmission line that is intra-state. Because if it goes into an interstate, you know that is a Washington issue. But I think that is a time to take a look at it. But if this industry was 10 or 15 years old already, I think we’d be having a different conversation.

Q: Ok one last question real quick. Climate change, the president has issued new rules regarding carbon dioxide at power plants. I want to know just briefly real quick, what your thoughts are on climate change and how going forward in the next administration should you be re-elected, do you plan to file a lawsuit, how are you going to react…

A: Well lets talk about the rules because they’ve only been issued by the EPA they haven’t been reviewed or approved by Congress. And I think rules that greatly change what’s happening in this country to the economy of this country, and particularly those are aimed directly at the coal industry right now that are going to cost Pennsylvanians 6200 miners jobs, tens of thousands of jobs beyond that but are also going to cost energy to go up because right now in Pennsylvania 40 percent of our electricity today is obtained through coal. You take a look at those two items and you go back and you look at the EPA in the not too distant past, where they required all these power companies to go in and put the scrubbers on, to come up and meet certain emissions levels and they meet them and then as soon as they do, they spend all this money, they move the goal line again without Congress approval, I think we need a much more universal approach…

Q: Are you going to join a lawsuit, against these rules?

A: Well I think, how do you know until you see what the final rule is, you know there’s no final rule yet. But I will tell you I support the coal industry, we have clean coal technology, we are able to do this, we ought to let the science do that.

Q: What about climate change, just real quickly.

A: Do we want to protect our climate? Absolutely we want to protect the climate.