Five Questions We Hope Chesapeake’s Shareholder Meeting Will Answer

-

Joe Wertz

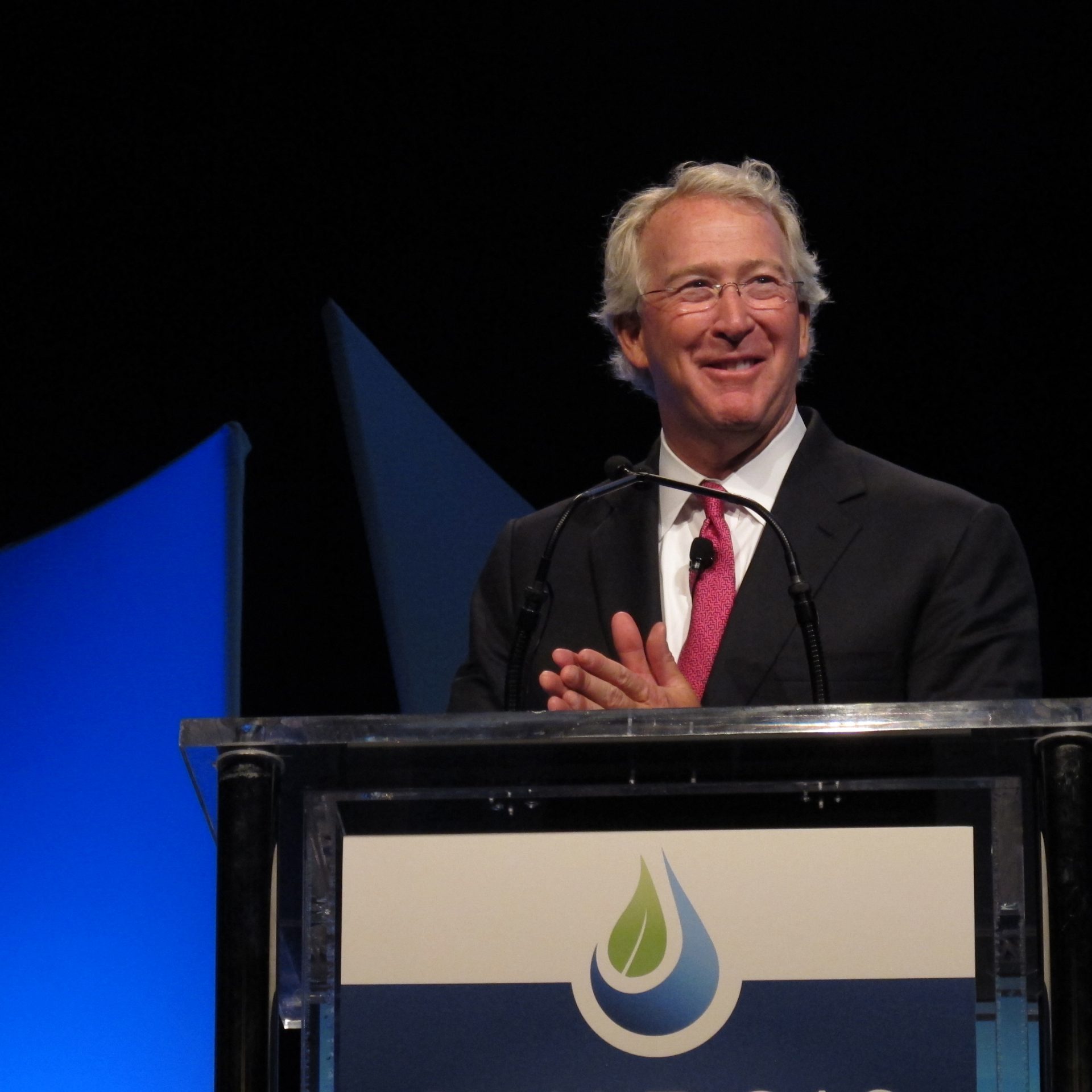

Chesapeake Energy has suffered weeks of damaging reports, investigations and revelations over its intertwined financial relationship with CEO Aubrey McClendon.

The company’s annual shareholder meeting is tomorrow. (Follow StateImpact’s live-blog of the event here.) Investors, analysts, activists — and Oklahomans — will be looking for answers.

There are a lot of questions. Here are five big ones we hope will be clarified:

1. Who Are the New Directors?

Four new members of Chesapeake’s nine-person corporate board wil soon be named.

Chesapeake has agreed to let its two largest shareholders name four new, independent board members. Southeastern Asset Management, which holds a 13.6 percent stake, will name three; billionaire activist investor Carl Icahn, whose 7.6 percent stake surfaced in late May, will select one.

One member will retire, and a replacement for McClendon’s chairmanship has yet to be named, but it’s unclear which board members are leaving.

Oklahoma State University President Burns Hargis and Richard K. Davidson, a former Union Pacific executive, are the only directors up for re-election at Friday’s meeting, so they’re considered the most vulnerable.

The board’s lead independent director, Merrill A. “Pete” Miller, has faced some criticism as well since his company, National Oilwell Varco, an international oil field service company based in Houston, has some business ties to Chesapeake.

Two other board members could be at risk because of their perceived ties to McClendon: former Oklahoma politicians Frank Keating and Don Nickles, writes Oklahoman energy reporter Jay Marks.

Lou Simpson is considered safe because he was added last year at the urging of Southeastern.

Chesapeake says the new board will be introduced by June 22, but revelations on who might step down — and who might step in — could be revealed at Friday’s shareholder meeting.

cosmicautumn / Flickr

Chesapeake's real estate operation includes Classen Curve, a high-end shopping center near the company's corporate campus in downtown Oklahoma City.

2. Which Assets Will be Sold?

Chesapeake holds more than $13 billion in debt, faces a $22 billion cash-flow shortfall, and is looking for ways to raise money.

Just two months after boasting about its Ohio land portfolio, Chesapeake has decided to sell a quarter of its Utica Shale leases, our partners at StateImpact Pennsylvania report.

And the company is in “advanced talks” to sell its pipeline interests to Global Infrastructure Partners for more than $4 billion, Bloomberg reported this week.

Shedding pipelines would be a retreat from Chesapeake Energy’s vision of so-called vertical integration, which involves owning oil and gas fields as well as ancillary assets.

Shares of Chesapeake soared on news of the potential pipeline sell-off, which was among the proposals Icahn said he’d push for.

Chesapeake has other “non-core assets” — like a massive real estate operation — which some shareholders would like corralled.

“They should not be involved in real estate development,” Brian Gibbons, an analyst at Creditsights Inc. in New York who rates Chesapeake bonds a buy, tells Bloomberg.

Michael Heiman / Getty Images

Kevin Durant celebrates with the trophy as Serge Ibaka looks on the Oklahoma City Thunder's defeating the San Antonio Spurs to win the Western Conference Finals. Chesapeake gives millions to the team, which is partially owned by CEO Aubrey McClendon.

3. What About the Oklahoma City Thunder?

Chesapeake has a $36 million sponsorship deal with the Oklahoma City Thunder. It pays up to $4 million each year to have the court branded as the Chesapeake Energy Arena, and the company is buying $3 million worth of tickets, many of which Retuers says were distributed to employees and business contacts.

McClendon has a 19 percent stake in the team, and Chesapeake’s spending on the franchise has almost doubled over the last four years.

This “underscores how the company’s board hasn’t always erred on the side of caution while overseeing McClendon’s potential conflicts of interest,” Bloomberg reports.

And shareholders have noticed. From Bloomberg:

New York City pension funds, which own 1.9 million Chesapeake shares, complained this month about the company’s spending on the National Basketball Association squad.

“… we have a real problem with a board that allows the use of the corporate treasury to support personal investments,” New York City Comptroller John C. Liu, who oversees the pension fund investments, told the news service.

The Thunder, of course, is headed to the NBA Finals, which increases the value of Chesapeake’s sponsorship and arena-naming agreement. But shareholders and analysts are calling for the company to focus on oil and gas.

Paul J. Richards / AFP/Getty Images

Analysts say Chesapeake's low stock price and vast natural gas portfolio could attract a buyout from larger energy company, like Exxon Mobil.

4. Will a Buyout be Brought Up?

Icahn and many others think Chesapeake is undervalued. Natural gas prices are sure to rebound, the thinking goes, and Chesapeake has the country’s largest portfolio of onshore drilling.

“For any of the major integrated oil companies that want to pick up reserves on the cheap, this would be a good one,” Peter Sorrentino, who helps oversee $14.7 billion at Huntington in Cincinnati, tells Bloomberg.

So who might buy Chesapeake? Exxon Mobil, Chevron and Shell might all be interested, analysts tell the news service.

And Icahn says the company’s board and management should be open to “would-be acquirers.”

5. What Will McClendon Do?

McClendon has been battered for weeks with investigations into his personal finances. He’s been forced to hand over the board’s chairmanship, his compensation has been cut, and his controversial CEO perk has been severed.

But McClendon has survived corporate controversy before.

“We’re in the middle of a pretty unprecedented media firestorm today,” McClendon told reporters in mid-May, according to a recording Reuters obtained. “I don’t exactly know the origins of it and I don’t exactly know when it ends, but I know that it will end, and we will emerge stronger. We will emerge more focused, and we will change in some ways that we probably need to change in.”

What else can McClendon do to assuage shareholders?