OK’s Cost of Online Buying: $185-$225 Million in ‘Avoided’ Use Tax

-

Joe Wertz

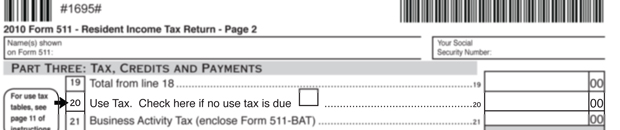

It’s on line 20 of the state income tax return form.

For five years, Oklahomans have been asked to declare the amount of certain purchases they made the year prior.

Joe Wertz / NPR StateImpact

Oklahomans are supposed to declare the amount of purchases from retailers that don't collect state sales taxes.

The use tax, also known as the “Internet sales tax,” covers items purchased from retailers that don’t collect Oklahoma sales taxes.

The problem is obvious: Taxpayers don’t seem inclined to self-report such purchases, and states like Oklahoma are losing millions.

From Oklahoma’s income tax packet:

If you have purchased items for use in Oklahoma from retailers who do not collect Oklahoma sales tax whether by mail order, catalog, television shopping networks, radio, Internet, phone or in person, you owe Oklahoma use tax on those items.

Nationwide, consumers are collectively responsible for a $23 billion deficit in taxes from Internet purchases, Paula Ross, spokeswoman for the Oklahoma Tax Commission told The Oklahoman. Ross, citing a study from the University of Tennessee (right-click here to download) analyzing state-by-state use taxes, said Oklahoma could be losing between $185 million to $225 million in such tax revenues each year.

“There’s no way to be sure if those are exactly correct, but as more and more people shop online, it’s fairly reasonable to expect that we’re losing that kind of money,” she told reporter Andrew Knittle.

The issue is two-fold.

First, States can’t collect online use taxes on their own. Doing so would violate interstate commerce laws, Ross told the paper.

Second, consumers are basically on an honor system when it comes to declaring their online purchases.

“The burden is on the consumers,” Ross told the paper. “We cannot make them pay the tax.”

Ross said it will ultimately be up to the federal government to take on the online use tax issue.

U.S. Sen. Richard J. Durbin (D-Illinois) recently proposed a federal law requiring Internet retailers to collect sales taxes, but the New York Times reported that the measure has yet to gain much traction.

Legislatures across the country have been going after online sales taxes as a way to shore up cash-strapped state budgets. Brick-and-mortar stores have backed such “e-fairness” efforts, both across the country and here in Oklahoma.