State Revenue Comes In Nearly 4 Percent Above Prediction In September

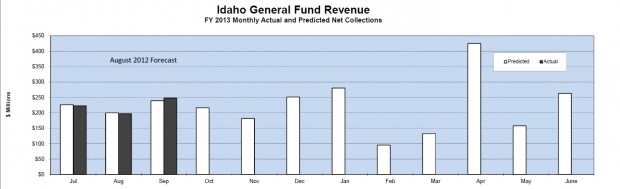

Tax collections to the state’s main bank account came in 3.7 percent above expectations for the month of September.

Three months into this fiscal year, Idaho tax collections are 5.7 percent above the previous year.

The Division of Financial Management’s general fund revenue report shows individual income tax, sales tax and product tax collections exceeded the monthly prediction.

Corporate income tax collections and miscellaneous revenue clocked in below forecast amounts.

“Corporate income tax collections were weighed down by lower-than expected filing and estimated payments. Estimated payments veered the furthest from its target, coming in at $28.2 million instead of the predicted $33.0 million. Actual filing payments were $3.7 million, which was $1.1 million lower than expected.” – DFM Revenue Report

Idaho’s general fund is the bank account lawmakers use to determine funding for most state government programs. It’s tracked closely and is one indicator of the state’s economic health. When projections are met or exceeded, that generally means more people are working and paying taxes.