Study: Idaho ‘Trailing Behind’ On Measuring Tax Incentive Effectiveness

A new 55-page report from The Pew Center on the States shows most states don’t really know if business tax incentives are boosting job growth.

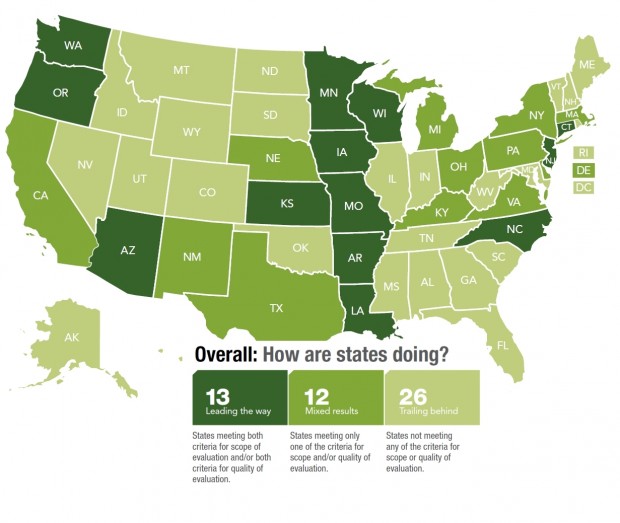

In case you don’t have time to read the full report, here’s what you should know: 26 states, including Idaho, don’t really know if the millions (in some cases billions) of dollars spent each year on tax incentives actually boost economic growth.

Pew Center on the States

26 states, including Idaho, are not meeting any of Pew's criteria for scope or quality of evaluation.

It’s an issue that’s been discussed for years in Idaho. And it’s a subject StateImpact continues to explore.

Pew’s study doesn’t take a stand on whether state tax incentives are good or bad economic policy. Rather, its report looks at what states are doing to evaluate the effectiveness of incentives. The criteria for evaluation: does the state have a system to inform policy choices, does it include all major tax incentives, can the state measure the economic impact, and does the state have a way to draw clear conclusions.

Idaho is “trailing behind” in each of the criteria outlined. Two of Idaho’s neighbors, Oregon and Washington, are “leading the way” and are used as positive examples throughout the study.