February Tax Collections Exceed Expectations

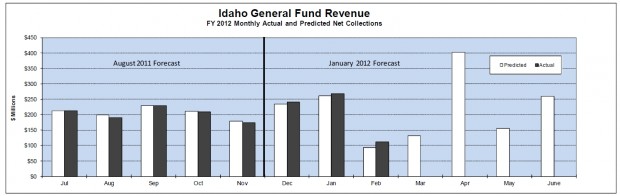

General fund tax collections have exceeded forecasts for three straight months, putting revenue almost $33 million above the forecast for the fiscal year. The Division of Financial Management reports February tax collections were nearly $20 million above projections. DFM says it’s the largest surplus of the fiscal year.

“Individual income tax revenue for the month topped its forecast by $13.7 million and corporate income tax collections exceeded the forecast by $5.1 million. Miscellaneous revenues added another $3.1 million to the surplus.” – DFM

Still, DFM reports the increase in individual income tax collections was unusual, and largely a timing issue.

“The receipts of $26.1 million were more than twice the predicted $12.4 million. Nearly all of the $13.7 million excess came from refunds that were $12.7 million lower than expected. This month’s low refunds are a timing issue. Continuing verification and review improvements by the Idaho Tax Commission result in returns processing slightly later than in the past.” – DFM

Sales tax collections came in slightly below forecast. DFM says net sales tax collections for the fiscal year are still above projections because of higher-than-expected revenue in December and January.

The state general fund is used to pay for state government programs. Legislators decide how and where to spend that money. Lawmakers are currently setting the budget for the next fiscal year, and a majority has said they plan on leaving a rainy-day account and room for tax cuts.