Idaho’s November Tax Collections Come In Slightly Below Forecast

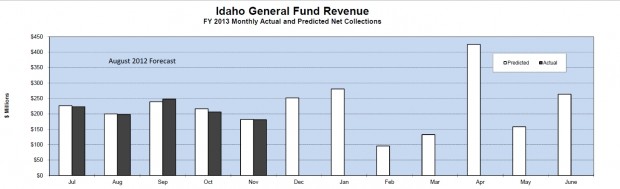

Idaho’s Division of Financial Management reports general fund tax collections for November were down slightly from projections.

The general fund is Idaho’s main bank account that’s used to pay for state government. Its balance is what legislators use to appropriate spending to all state agencies.

The largest shortfall in November came from individual income taxes, which came in $6.7 million below forecast.

“Idaho individual income tax collections of $82.9 million for the month came in $6.7 million below its target of $89.5 million. This shortfall was partially offset by stronger-than-anticipated corporate income tax receipts. The corporate income tax was expected to shrink by $2.0 million in November, but actually increased by $2.2 million, resulting in a net excess of $4.2 million.” – DFM General Fund Revenue Report

Sen. Dean Cameron is chairman of the Legislature’s main budget committee. He says it’s good news Idaho’s sales tax numbers continue to increase, but the bad news is individual income tax withholdings haven’t rebounded. Individual income tax collections are a direct result of the number of people with jobs.

“What that tells me is, industry, as they went through this recession, and they reduced their workforce — they haven’t gone back and filled those in,” says Cameron. “I don’t think we have a true recovery until those jobs are filled.”