Background

This page is no longer being updated. For ongoing coverage of this topic, go to Boise State Public Radio’s website.

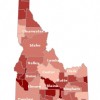

The Boise-metro market was hardest hit in Idaho’s housing crisis, with foreclosures concentrated in Ada and Canyon Counties.

Idaho’s housing boom was centered around its two main metropolitan areas, Boise and Coeur d’Alene.

John Starr of the global real estate company Colliers International had a front-row seat as capital poured into the local housing markets in the years preceding the bust.

When he thinks of the early 2000s, he remembers watching land prices rise with demand, and house lots shrink. What the area wound up with, he says, were more and more subdivisions, packed tight with houses.

Census data show that the state’s population grew by more than 28 percent from 1990 to 2000, and by more than 20 percent from 2000 to 2010. Starr said that’s due in large part to growth at Micron Technology. That growth, in turn, fueled Idaho’s housing boom.

“The reason we were doubling the national average growth rate was we were moving in a whole bunch of people that we couldn’t produce here in Idaho, namely electrical engineers and so forth to work at Micron. The data points that people were looking at that were helping them make decisions about coming to Boise and deploying capital and building and helping us grow – those data points were skewed.” – John Starr, Colliers International

According to Metrostudy, a housing and data information company, Boise’s housing market began to bottom out in 2009.