Five Ways Paying For College Has Changed In The Last Five Years

Sallie Mae released its annual look at how America pays for college earlier this week. About 1,600 students and parents responded to a survey that asked about college costs and financing. The student loan lender started conducting the research in 2008.

Here are five ways paying for college has changed in the last five years.

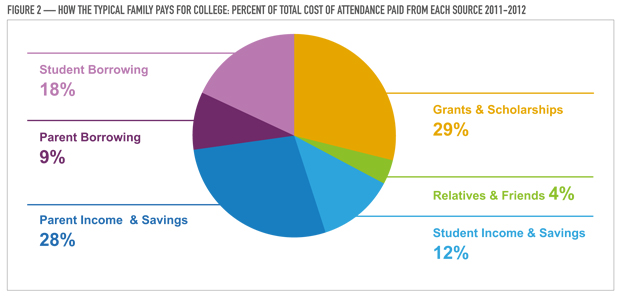

- Students are paying a higher share. They kicked in an average of $2,555 from their own income and savings, up nearly 7 percent from last year. They’re borrowing more, too — 18 percent took out a loan to finance their education, bringing the average student contribution to $6,274.

- Families are becoming more cost conscious when it comes to college. Spending on higher education declined for the second year in a row. In 2012, 69 percent of families said they eliminated a school based on cost, up from 56 percent in 2009. Half of all students from low-income families reported eliminating schools even before applying because they were too expensive.

- Parents are contributing less than they did two years ago. In 2010, parents paid for 37 percent of their child’s tuition, making an average contribution of $8,752. In 2012, the average parent contribution was $5,955, down 32 percent from its peak two years ago. Few parents — just 19 percent — said they’d be willing to send their child to college for the experience.

- Fewer colleges are offering scholarships. In 2011, middle-income families reported receiving more scholarships and grants directly from schools, but a difficult economic climate dialed back that spending. Just 35 percent of families received scholarships last year, down from 45 percent in 2011.

- Students aren’t carrying high credit card balances. Students reported a median balance of $196. A third reported carrying no balance at all, and less than 10 percent reported a balance higher than $2,000. Overall, two-thirds of students said they had cut back on spending so they could pay higher tuition outright. More than half reported living at home to save money, up nine percent from last year.

According to the report, just 39 percent of families had a plan for paying for college before enrolling.