Background

This page is no longer being updated. For ongoing coverage of this topic, go to New Hampshire Public Radio.

______

For personal and corporate finance, New Hampshire tends to favor smaller local and state banks over larger institutions. According to numbers from the FDIC, New Hampshire hosts nine commercial banks. Only one of these has assets worth more than $1 billion. And among the state’s 15 savings banks and credit unions, there is also only one institution with more than $1 billion in assets. Most savings and commercial banks report somewhere between $100 million and $1 billion in assets.

Compared to lenders in other states, New Hampshire’s financial institutions have weathered the recession relatively well. While 2009 was The Year of the Failing Bank across most of the country, with the FDIC taking over 140 institutions, New Hampshire remained unscathed. The last time a bank failed in the state was well before the recession, back in 2001. That’s when the FDIC shut down First Alliance Bank & Trust Company in Manchester.

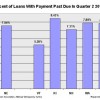

But New Hampshire’s financial sector hasn’t been completely untouched by the economic meltdown. In 2009, the state saw a 32.2 percent increase in bankruptcy filings over the previous year. That’s a faster increase than the rest of New England saw, and slightly above the increase in filings nationwide. The same year, commercial banks reported $91.7 million in unpaid loans and leases.

There is a relative bright spot in these dim numbers. New Hampshire now ranks 50th in the nation for the ratio of unpaid commercial obligations to paid loans and leases.