Background

Emmanuel Dunand / AFP/Getty Images

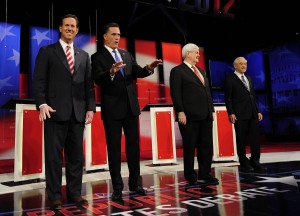

Republican presidential hopefuls Rick Santorum, Mitt Romney, Newt Gingrich and Ron Paul take part in The Republican Presidential Debate in Florida.

Republican presidential candidates Ron Paul, Rick Santorum, Mitt Romney and Newt Gingrich during their debate on Feb. 22, 2012 in Arizona.

Idaho has 32 delegates up for grabs during its March 6 Republican caucus. Ahead of the caucuses we thought it’d be a good time to look at the economic priorities of the four Republican front-runners.

Each of the candidates visited Idaho in February. Newt Gingrich stumped in Coeur d’Alene. Ron Paul hosted rallies in Twin Falls, Boise and Moscow. Rick Santorum spoke in Coeur d’Alene and Boise and Mitt Romney held a fundraiser and public rally in Boise.

The four remaining candidates agree on a handful of issues, including repealing the Patient Protection and Affordable Care Act, eliminating the estate tax and repealing the alternative minimum tax.

We’re only highlighting the candidates’ proposals for individual income tax rates, corporate tax rates, and federal spending. Here are the candidates’ economic plans, in alphabetical order:

Newt Gingrich

Corporate Tax: Lower the highest corporate tax rate from 35 percent to 12.5 percent. Repeal the payroll tax cut in the future.

Spending: Gingrich’s website doesn’t detail how he plans to cut federal spending, instead it says this: “Balance the budget by growing the economy, controlling spending, implementing money saving reforms, and replacing destructive policies and regulatory agencies with new approaches.” Gingrich wants to replace the Environmental Protection Agency with the “Environmental Solutions Agency.” He wants to privatize parts of Fannie Mae and Freddy Mac, repeal the Sarbanes-Oxley Act, repeal the Community Reinvestment Act and repeal the Dodd-Frank Law.

Ron Paul

Corporate Tax: Lower the highest corporate tax rate from 35 percent to 15 percent. Allow tax-free repatriation.

Spending: Paul has detailed plans for reducing government spending, much of which includes eliminating entire federal agencies. Cut $1 trillion in federal spending during the first year in office and eliminate five cabinet departments: Energy, Housing and Urban Development, Commerce, Interior and Education. Eliminate the IRS and Transportation Security Administration. Freeze pay for federal workers and reduce the workforce by 10 percent. Repeal the Dodd-Frank Law and Sarbanes-Oxley Act. Increase or maintain spending levels for Defense, Department of Veterans’ Affairs, Transportation, Medicare, Social Security, Veterans’ Benefits and Federal/Military Retirement. Return to the gold standard.

Mitt Romney

Corporate Tax: Reduce the top corporate tax rate from 35 percent to 25 percent. Allow a tax holiday for repatriated corporate profits. Transition from a worldwide to territorial tax system.

Spending: Cap federal spending at 20 percent of Gross Domestic Product by the end of his first term. In order to make that happen, Romney says $500 billion needs to be cut per year “assuming robust economic recovery with 4 percent annual growth.” Cut non-security discretionary funding by 5 percent across the board. Privatize Amtrak, reduce Subsidies for the National Endowments tor the Arts and Humanities, the Corporation for Public Broadcasting, and the Legal Services Corporation. Eliminate Title X family planning funding and reduce foreign aid. Repeal the Davis-Bacon Act. Reduce the federal workforce by 10 percent through attrition and “align federal employee compensation with the private sector.”

Rick Santorum

Income Tax: Cut the individual income tax to two rates, 10 percent and 28 percent. Lower the capital gains and dividend tax rates to 12%, eliminate the estate tax, triple the tax deduction for each child, eliminate marriage tax penalties.

Corporate Tax: Cut the corporate tax rate in half, from 35 percent to 17.5 percent, and eliminate the tax for manufacturers. Tax repatriated corporate profits at 5.25 percent, eliminate the tax if its used to invest in equipment. Increase the research and development tax credit from 14 percent to 20 percent and make it permanent.

Spending: Cut $5 trillion from the federal budget in five years. Reduce federal non-defense discretionary spending to 2008 levels. Cap federal spending at 18 percent of gross domestic product. Freeze spending for defense, Medicaid, education, housing, food stamps, job training and block grants for five years. Stop implementation of any further stimulus funding to the states. Freeze non-defense federal employee pay, cut the federal workforce by 10 percent and phase out defined benefit plans for new federal workers. Eliminate all energy subsidies and most agriculture subsidies. Eliminate funding for Planned Parenthood. Eliminate the Dodd-Frank law. Phase out Fannie Mae and Freddy Mac within five years.

Information for this cheat sheet comes from the candidates’ websites and the Tax Policy Center at the Urban Institute and Brookings Institute.